Realtor fees and closing costs calculator

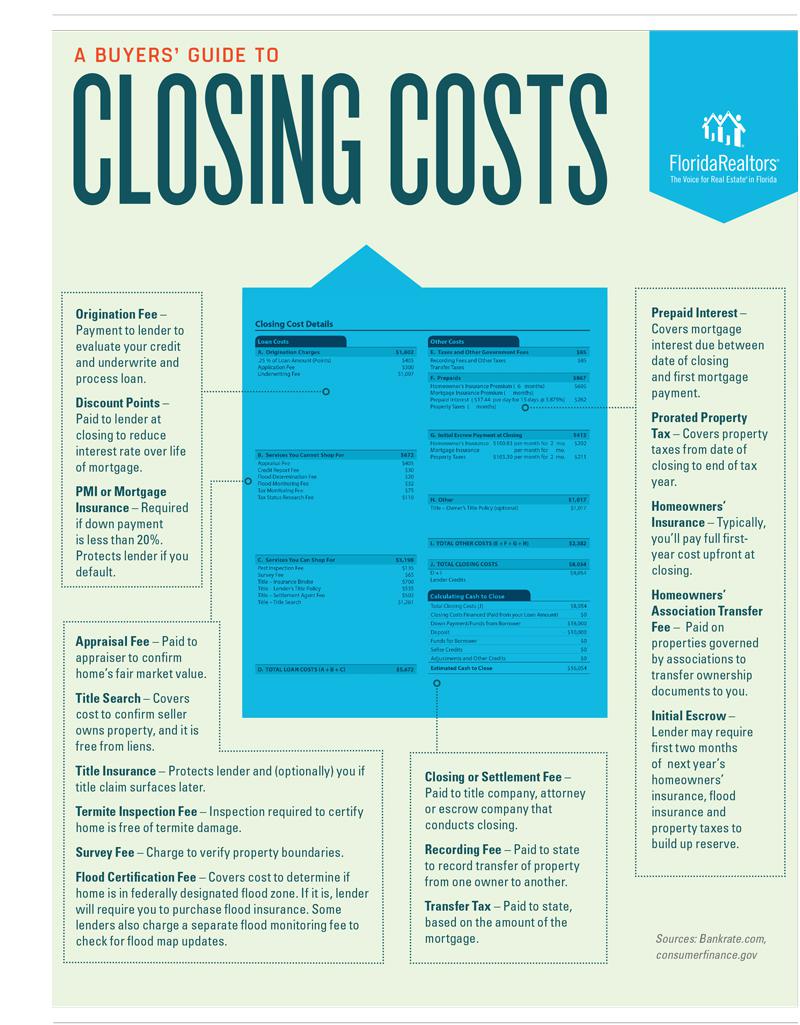

For a more accurate estimate of closing costs experts recommend that buyers save between 2 and 5 of the homes value to put towards closing. However the borrower is responsible for closing costs.

Home Buyers Closing Cost Calculator Mls Mortgage Closing Costs Mortgage Home Loans

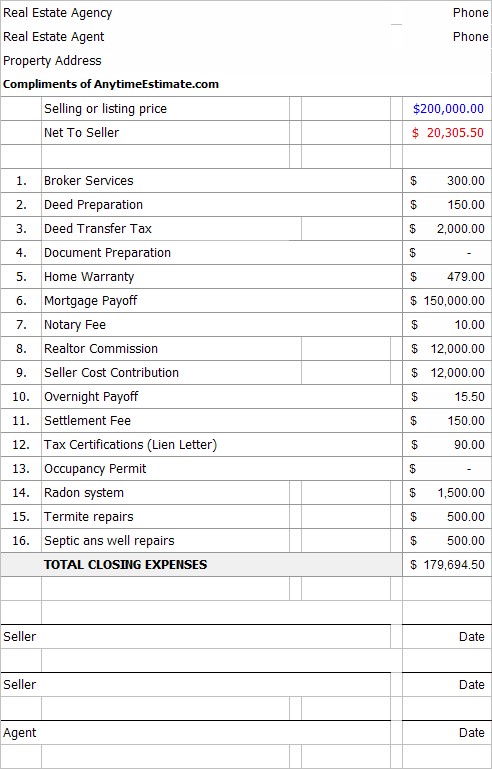

Average seller closing costs Calculator What fees do sellers pay at closing.

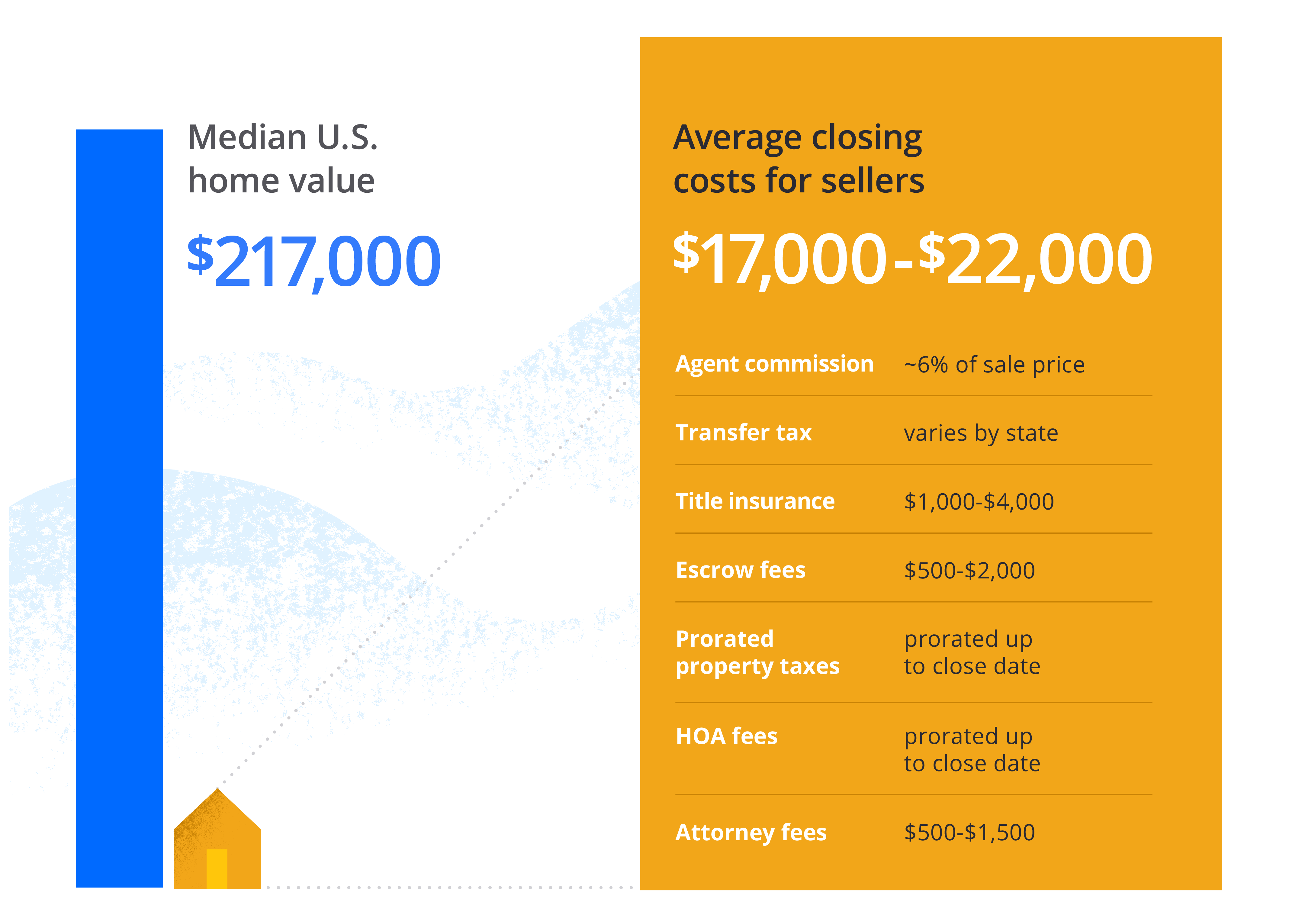

. In some states. When you buy or sell a house you must pay a set of taxes and other fees called closing costs. For sellers closing costs can add up to 810 of the home sale price on top of repaying any debts or liens related to a property.

We use local tax and fee data to find you savings. Closing costs are an assortment of fees including fees charged by. Real estate is expensive and with the added cost of home inspections closing costs real estate agent fees and so on its best to make sure you can afford the house before you get locked.

There may be some effect on fees or taxes but they will not likely be significant. May 23 2022 at 1128 am. When finalizing a property sale both buyers and sellers owe a number of closing costs.

Closing costs are typically independent of down payment and are applicable to any type of loan. Mortgage closing costs are the fees you pay when you secure a loan either when buying a property or refinancing. Zillow has 2358 homes for sale.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Some lenders charge a small fee when you submit your application. The total commission is a fee paid at closing by the home seller unless some other arrangement has been made.

In most real estate transactions closing costs come right out of your sales profits. She is passionate about helping buyers through the process. They still net the same 150000 in this example.

Saving on realtor fees doesnt have to mean sacrificing service. Think of costs like the appraisal taxes survey etc. VA Mortgage Calculator VA Loan Limits.

Some lenders allow borrowers get a loan with no or reduced closing costs or origination points but compensate for that with higher interest rates or other fees. Clever beats Redfin on price with its 1 listing fee though Redfin does drop its rate from 15 to 1 via a 05 rebate if you sell and buy with a Redfin Agent within the same year. Use this Florida closing costs calculator to see.

It offers a lender credit of up to 7500 that can be used towards non-recurring closing costs like title insurance and recording fees or to permanently buy down the interest rate discount. Discount points Mortgage discount. There is no cut-and-dried rule about whothe seller or the buyerpays the closing costs but buyers usually cover the brunt of the costs 3 to 4 of the homes price compared with sellers.

For sellers in Illinois real estate agent commission fees alone can easily exceed their total closing costs. Attorney fee 150 to 500. How to save on seller closing costs FAQ.

Find a top local agent today. Use SmartAssets award-winning calculator to figure out your closing costs when buying a home. There are costs you will have that are mandatory such as stamp tax deed prep pro-ration of property taxes and if you hire a Realtor their fees as well.

VA home loan closing costs and fees. The amount of down payment offered has very little if any affect on closing costs. Closing costs are fees that lenders charge a borrower or home buyer to acquire a mortgage loan.

Its typical to make an earnest money deposit when you put an offer in on a home. They typically total 2 to 7 of a homes purchase price. One-time closing costs and fees 0 Origination charges title insurance.

More on buyer closing costs later. A lender the title company attorneys insurance companies taxing authorities homeowners associations real estate agents and other closing settlement related companies. VA loan closing costs average around 1 to 3 percent of the loan amount on bigger home purchase prices and 3 to 5 percent of the loan amount for less expensive homes.

These closing costs are typically paid at the time of closing a real estate transaction. You may be able to increase your purchase offer by the amount of your closing costs. You should expect to pay between 2 and 5 of your propertys purchase price in.

Loan costs and other non-loan costs. Seller closing costs are fees you pay when you finalize the sale of your home in Florida. Origination Costs To originate a reverse mortgage lenders may charge an origination fee.

For example lets say youre buying at 150000 and your closing costs are 5000. These expenses cover the cost of finalizing the sale and transferring the propertys title into the buyers name. Not all VA closing costs are transaction fees or even related to the VA home loan itself.

Seller closing costs typically add up to 1-3 of the sale price while buyers generally owe around 3-5. As a buyer you can expect to pay 2 to 5 of the purchase price in closing costs most of which goes to lender-related fees at closing. In Tennessee the median home value is 166900 therefore prospective buyers should expect to pay between 3338 and 8345 in closing costs.

Redfin is a well-known discount brokerage that advertises 15 listing fees minimum fees apply for sellers and commission rebates for buyers in select markets. Closing costs for sellers can reach 8 to 10 of the sale price of the home. Earnest money is not technically considered a closing cost nor does it factor into a buyers 2 to 5 range but it plays an important role in your total payment on closing day.

The commission is typically a percentage of a homes. The average amount ranges between 1 to 3 of the offer price and its deposited into a third-party account to show the. What you ultimately owe at closing and your overall costs can be broken down into two categories.

A down payment is not required on VA loans. Its higher than the buyers closing costs because. This is also sometimes bundled with the origination costs.

You may be able to increase your offer to 155000 and have the seller use those proceeds to cover your closing costs. A lender cannot charge more than 2500 or 2 of the first 200000 of the homes value plus 1 of the amount over 200000. Youd only have to pay out of pocket if your closing costs exceed the amount you earn from the sale which rarely happens.

How much are realtor fees. These include the costs of verifying and transferring ownership to the buyer so most are unavoidable. In general the origination fee compensates the lender for the processing of a Home Equity Conversio n Mortgage.

Application fee 100.

Download Real Estate Closing Costs Good Faith Estimate

Seller Closing Costs Net Calculator Tutorial

Closing Cost Estimator For Seller In Nyc Hauseit New York City

Calculate Closing Costs For Seller Online 55 Off Www Ingeniovirtual Com

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gr Real Estate Tips Real Estate Infographic Real Estate Investing

The Buyers Guide To Closing Costs Florida Realtors

Calculate Closing Costs For Seller Hot Sale 59 Off Www Ingeniovirtual Com

Closing Costs Explained How Much Are Closing Costs Zillow

Mortgage Closing Costs For Buyers True North Mortgage

Download Real Estate Closing Costs Good Faith Estimate

Florida Seller Closing Costs Net Proceeds Calculator Closing Costs How To Memorize Things Printable Worksheets

How Much Does It Cost To Sell A House Zillow

How To Calculate Closing Costs On A Nc Home Real Estate

Florida Seller Closing Cost Calculator 2022 Data

Calculate Closing Costs For Seller Hot Sale 59 Off Www Ingeniovirtual Com

Closing Costs For Buyers And Sellers In San Mateo County Burlingame Properties